Speak 0:17

Welcome back. As promised, this episode will focus on what Republicans refer to as Bidenomics. Bidenomics has different meanings one for Biden critics and one for Biden supporters. Primarily, I hear Trumpers saying Bidenomics, and when they say it, they mean high gas prices, high grocery prices, credit card mortgage rates and illegals getting free government handouts. They scoff at Biden’s economic policies, the way liberals mock the era of Reaganomics, where taxes were reduced, the debt skyrocketed, and the only thing that increased by a trickle were paychecks. On the other hand, Bidenomics is defined on WhiteHouse.gov, and we know who runs that. Bidenomics has a three point policy, they say based on three pillars, which are: making smart public investments in America. Okay, who wants stupid ones, right? Empowering and educating workers to grow the middle class. And we’re going to focus on the Middle class in this podcast today. Then thirdly, lower costs for small businesses and entrepreneurs.

Now, why do we want to talk about the middle class? Well, Trump pursued policies that strengthened the upper class, despite Warren Buffet’s observation that “There’s class warfare. All right. But it’s my class, the rich class that’s making war, and we’re winning.” [Audio clip]

Keep in mind, Warren Buffett is the fourth or fifth richest man in America. How is strengthening the middle class important? Here’s how. And we have to go back a ways to understanding this. Back to 1848, when Karl Marx and Friedrich Engels published The Communist Manifesto. They declared that world history was the story of the struggle between the Haves, also called the bourgeois, the rich and powerful who owned businesses and government versus everyone else the workers, the Have-nots. Two classes, the bourgeois and the people who worked, the wealthy and the not wealthy. In a nutshell, they saw the world had a world. History has a natural order, an ongoing process wherein the wealthy cannibalize themselves through competition. So and we see that small business guy gets ran out of business. He’s no longer a wealthy Have person, or the big company buys the little company and makes him a worker. And he goes down and joins the working class there, end up becoming, they end up becoming Have nots and eventually the Have-nots would rise up and create a community for all, not just for a few. All of this would happen on its own. It was natural, according to Marx and Engels, what they didn’t see in history was the obstacle, the emergence, a stumbling block of the middle class. And that, ladies and gentlemen, is another reason Sleepy Joe values strengthening the middle class. The majority of Americans are in the middle class. And it prevents the natural and historical move towards communism. Two things have helped strengthen the middle class: Government and unions. Strengthening the middle class depends on citizen participation. So policies like

letting women vote, using getting rid of the poll tax and that’s poll p-o-l-l. (We used to have to pay to vote.) Civil Rights Act, etc. are all tools that work together to strengthen the middle class. Policies that expand power and wealth to a few, the Haves, unwittingly bring us closer to communism. America is great because of our middle class. Supporting policies that strengthen it indicates true American patriotism.

Policies that benefit the rich at the expense of the middle class support classical Marxism and proponents of that don’t even don’t even know it. In this regard, Trump’s move to cut taxes and remove regulations which protect the middle class, like changing the laws on who qualifies for overtime pay, reducing the number of OSHA inspectors, proposing a budget to reduce Medicare funding, and pushing for a corporate tax cut to give call center companies a 50% tax break on foreign profits. Let’s move jobs overseas.

So the first two points of Biden’s economic plan, smart public investment, strengthening of the middle class. And finally, his third point, promoting competition to lower costs and help entrepreneurs and small businesses thrive. Make up the definition of by.

As far as I’m concerned, Biden has succeeded in making smart public investments, primarily spending in the pandemic spending, to improve our infrastructure. Funny to me, he is one Republicans who voted against the infrastructure spending. Hold press conferences. I’m bringing the bacon home. Such as Congresswoman Salazar.

I don’t even know what to say. You’ve got Republicans voting against a Democrat sponsored bill. They get a lot of money. They bring it to their county or their district, and then they act like, hey, look what I’m doing for you.

Oh, well. Biden has clearly sided with the workers. He obviously recognizes Abe Lincoln’s words from this sound clip that I got of Abe saying that his 1861 speech to the State of the Union.

That really wasn’t Abe’s voice. Here at DumptyTrumpty.org, we’re getting to be high tech. That was an artificially intelligence, generated text, a speech converter. In support of small businesses, which include family farms, Biden announced there have been more than 14 million filings for new businesses. Many of those jobs might be side gigs for people, but that’s often how businesses start. They also note that America has seen the fastest growth of black businesses in 30 years. That’s about time. And these things of the Democratic version, these things of the Democratic version of Bidenomics makes the plan a success. So let’s look at the Republican version of Biden’s mix.

Firstly, there’s often hyperbole, dramatic adjective used to describe inflation, hyper inflation, rampant inflation. Inflation’s out of control. When discussing inflation with Republicans, help them remain calm by agreeing inflation is costly, but it’s not running amuck. Rampant inflation is what tore across Germany after World War One in 1921. $1 was worth 90 German Marx also called the the Marx. Two years later, $1 was worth 1 trillion. Marx. A loaf of bread went from Denmark 160 to 200 billion German. Marx. That’s out of control inflation. And that’s not what we have. So let’s get straight into inflation and look at its causes. Firstly, inflation itself is often a good thing.

I mean, if you’re in business making screwdrivers, you’ll want to sell them at a higher price than a year ago. Imagine the opposite being in a period of prices drop being called deflation when you’d be selling your skwewdwivers for less than it cost to make. No, thanks. Right. Low steady inflation is helpful, especially if you own a home. You want to sell your home for more than you paid for it. That’s inflation. Rapid inflation however, is painful, and our inflation rates began accelerating during the Trump years. Well, what causes it?

Great question. There are books, classes, professors, economists, politicians who debate these things throughout the year. Now, I’m not either one of those, but I was a financial adviser and familiar with the subject. Basically, there are two theories of inflation. One is the supply and demand school. It predicts when there is a decrease in availability of an item called supply or an increase in supply. Those ups and downs will affect prices. So, for example, if there are fewer houses available, home prices go up. When housing supply goes up, prices go down. On the demand side, with an increase in desire also known as demand for items, it’s similar.

Using our house example, prices will increase when people want to buy houses and we’ll get what’s called “a seller’s market”. Then when people don’t want to buy houses, you have to cut the price to get it sold. So that lowers the price. Now combine the two.

When there are fewer homes available and millions of people want to buy homes, we’ll see rapid housing inflation. Now, this theory was developed by an Englishman, John Maynard Keynes, that’s spelled k, e, Y, N, E, S. who died in 1946. It’s called “Keynesian economics”. And it’s still the most prevalent economic theory today. Keynes theory easily explains much of our recent inflation. For instance, most of the semiconductors come from China, Taiwan, the world’s largest port is Shanghai, China. The third largest is Shenzhen, and the second largest is Los Angeles. When COVID reappeared, when that second wave came through, China returned to lockdown, factories shut down. No one was allowed to load cargo ships.

Availability supply just got nuked. Demand stayed constant or it increased. Remember when car prices went up, there was like a six month order, nine month order to get a car. Well, what did consumers do then? They started buying used cars, then used car prices jumped. Remember lumber, copper prices going through the roof. At one time, a local sandwich shop couldn’t make anymore BLT because they couldn’t get bacon. Presidents don’t control those global supply chains. Presidents can affect supply and demand, but only through policy and most policies require congressional cooperation. The other theory of inflation is predicted by monetary policy.

Monetary policy focuses on how much cash is available in America. That’s cash on hand and checking savings account money and loans and money loaned between banks. But first, the money has to be printed. That’s how it gets into circulation. This this is called money supply. And it’s a rather interesting number to watch. It’s reported as M1, M2 or M3 and gives us different measurements of money supply to watch. Back to Keynes, we know when there’s more of something it loses value. Same for dollar bills. When the government prints more money, gives it to the banks, the dollars we have in our pockets lose a bit of value. This is inflationary. Well, why do we even print money? We ask. Huh? Because we spend it. The government obligates us to fund things. So government spending increases the printing of money. The money supply grows. It becomes less valuable. That’s inflation.

Let’s look at government spending since the turn of the century. I’m going to say this twice because that’s important. The term for presidents begins with the first month of the year. A presidential year runs January 20th to January 20th. Okay. The term for presidents begins with the first month, January and counted January to January. But not so for our government’s budget. The fiscal year always starts for the federal government anew on October 1st until the next October 1st. It’s called a fiscal year. People say f y for short. Let’s count that out for a presidential election year and see. So let’s go back to October 2020. Trump was president. The new budget did not begin until October 1st of 2020, and it is called that one was called fiscal year 20 1fy 21 because the budget covers most of the following year.

Fiscal year 21 began October 1st, 2020. Then came the election in November 2020, while still under Trump’s budget in December, January 20th, still under Trump’s budget from January 20th to October 1st of 2021, the government lived under Trump’s budget. That’s what Biden had to use to operate, and that’s the way it is for every first term president. Their year always starts under the last president’s budget and lasts for eight months and ten days until October 1st, 2021.

Biden’s administration operated on Trump’s budget. Okay, We know how supply and demand works. So now let’s look at government spending. To gain some perspective, I’ll briefly mention GW, Bush and Obama spending. This data comes from fiscaldata.treasury.gov. You got to go with that. They’re the ones that run the budget. There’s all kinds of reports out there and it’s it’s difficult picking a source that you believe is reliable. But so I went with the Treasury Department.

During GW fiscal year reign, October of 2001 to 2009, 5.7 trillion was added to the U.S. debt more than all previous presidents combined since the first GW George Washington. When Obama arrived total debt grew by 11.9 trillion to a whopping 20.2 trillion, beating GW record. The Trump years added 8.2 trillion, less than the Obama years, but Trump was only president for four years, half the time of Obama and half the time of GW. For the third, for the three fiscal years of Biden’s reign, 4.7 trillion has been added and we were at 3.1 trillion with the end of fiscal year 2023. Just over six months ago in October.

Let’s make it easier to remember. If we average the amount of debt added per year for each president, we discover GW added 712.5 billion a year. That’s that’s the amount added to the debt divided by years. Now, it’s not accurate because some years spent more than others, etc. So it’s not a straight line. The figures are GW 712.5 Billion, Obama spent on average 1.03 trillion. Trump spent 2.05 trillion, nearly double Obama’s rate, and calculating only the three years we have so far, Biden’s rate is 1.56 trillion.

Trump’s pace set the world record of government spending and government debt, and that record still holds today.

With demand for goods increasing, who could not predict inflation was coming? Do you think inflation shows up immediately? Nope. Perhaps for a few things like gasoline, but items such as beef, chicken, lumber have a lag time. It’s kind of like having a turbo diesel car smashed on the gas pedal and it takes the car a second or two to lurch forward. Trump’s 2017 tax cut, which the nation didn’t need but the wealthiest and corporations enjoyed and the likely increase in government spending grew the U.S. debt by a whopping 41%.

Trump’s budget, not his term, but under his budget. Remember, this is patriotic Joe’s first nine months. Inflation under Trump’s last budget accelerated from 1.4 to 5.4% in nine months. That’s a 214% increase! Biden came into office with inflation already accelerating at its fastest pace yet, and it continued to accelerate from 5.4 to 8.2 under Biden’s first budget, but at a much slower rate. unfortunately, the federal chairman, a Trump appointee, misinterpreted the data and did nothing to show to slow inflation. Now, the Federal Reserve sets interest rates and that can influence demand. People don’t like borrowing at higher rates.

The Fed did nothing until March of 2022, but we had inflation data appearing in 2021. They ignored it and then it wasn’t until March, what, 14 months into Biden’s presidency, they finally began to raise interest rates. We went through 24 months of growing inflation before the Fed raised rates seriously.

The main benefits of inflation have been 1) the supply line choke points 2) the rapid expansion of debt under Trump. 3) the Fed’s neglect in raising rates quickly, (which they later admitted) 4. Biden’s spending, faster than Obama’s, slower than Trump’s. And the main thing reason number 5. the one the Republicans don’t want to discuss is Low Unemployment. lots of people working increases inflation. Working people spend money, buying products, increases demand lower supply. That’s inflationary. Because of Trump’s ineffectiveness in distributing the vaccine, America endured the worst unemployment, hitting four months of double digit rates. Unemployment When Joe took over was 6.4%, and last month it sank to the lowest level since before G.W.. Now Trumpers will say those are just people going back to their pre-COVID jobs. First off, that doesn’t matter. When one is laid off, they are eligible for unemployment. As the Bureau of Labor Statistics, the BLS has always done. They add those people’s names, numbers to the unemployment report when the job re-establishes they returned to work. The Bureau of Labor Statistics records that as a new job. Don’t like it, maybe? It’s just the way it is. Millions of Americans lost jobs under Trump’s COVID response. Biden has added 5.4 million MORE jobs than Trump’s highest number during his entire four years. Get that more word. Biden added 5.4 million more jobs than Donald Trump’s best record.

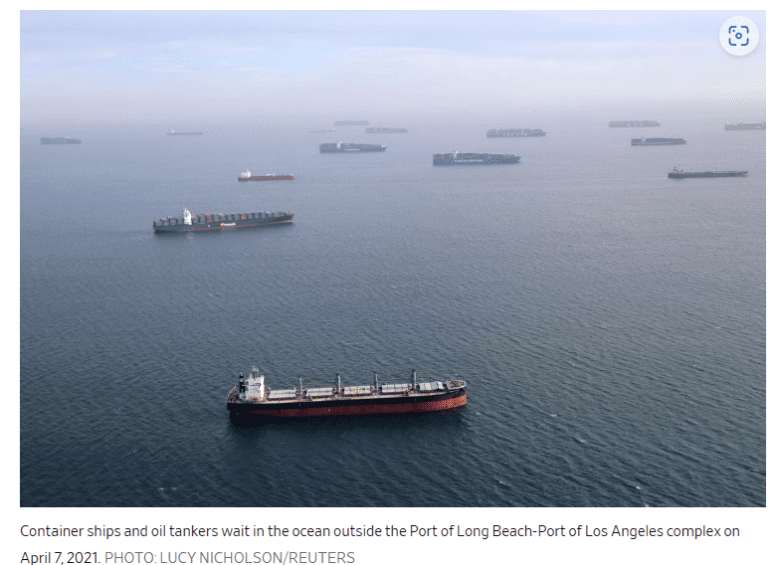

Okay, that’s enough on inflation. We’re not even going to discuss inflation around the globe. In comparison, we’re fine. We’re fine. Here’s your takeaway: Supply was cut when China shut down. Cargo ships could be seen for miles off the coast of Los Angeles waiting to get into the ports. Government debt skyrocketed under Trump. The Federal Reserve, who I think deserves the greater part of the blame, was slow in responding. And we’ve got great unemployment numbers. We’re not out of the woods. The goal is to have a 2% inflation rate. We’re at 3.4. It’s actually gone up a little in the last month. It’s known as the CPI Consumer Price Index, and that’s tracked monthly. Homeowners like home prices going up. But car owners don’t like gas prices going up. And that’ll be next week’s discussion of Bidenomics. Remember to follow us on Facebook, Blue Sky, Twitter and soon on our website Dumpty Trump, Dawg. Be sure to share this podcast with friends and family, help other Americans push Trumpism off their MAGA wall. thanks for your time this time. Until next time, I hope and encourage each of you as we go through our lives in this divided nation of ours, united in this common common goal. I’m Captain Scott. Have a great week.

RESOURCES

Monetary Policy

https://www.investopedia.com/terms/m/monetarypolicy.asp

https://en.wikipedia.org/wiki/Money_supply

Marx

https://www.britannica.com/question/What-is-communism

Inflation Calculator Bureau of Labor Statistics

https://www.bls.gov/data/inflation_calculator.htm

Presidential Debt

https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding

Historical Inflation

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Federal Reserve Error

https://www.foxbusiness.com/politics/powell-fed-wrong-inflation-not-transitory

Tax Breaks for Off Shoring

https://cwa-union.org/sites/default/files/20180306-cwa-cbb-bank-offshoring-report.pdf